Industry leaders see rapid innovation in CVD SIC COATING technology. Growing demand for advanced electronics and energy applications drives new investments. Companies quickly adapt strategies to capture market share. They prioritize efficiency and durability. CVD SIC COATING solutions now help businesses strengthen their competitive position and accelerate overall market growth.

Key Takeaways

- CVD SiC coatings improve durability and heat resistance, making them essential for electronics, aerospace, and energy industries.

- New technologies and smart manufacturing boost coating quality and production speed, helping companies stay competitive.

- Sustainability and supply chain strategies shape the market’s future, encouraging cleaner processes and local sourcing.

CVD SiC Coating Market Drivers in 2025

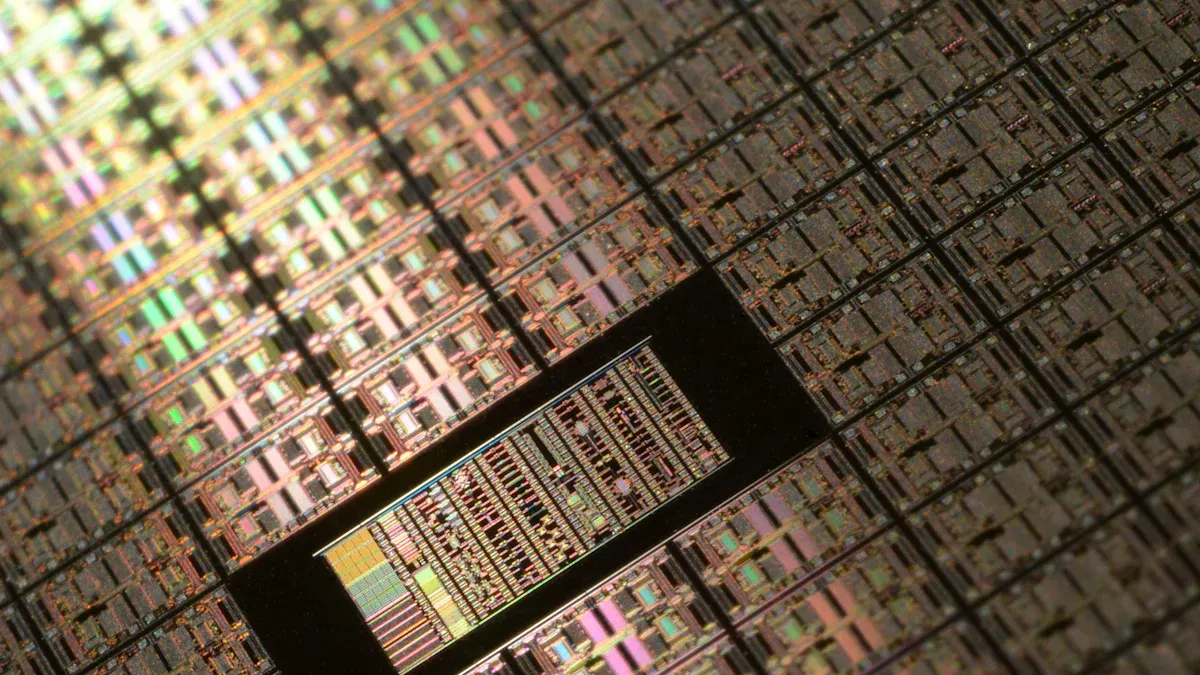

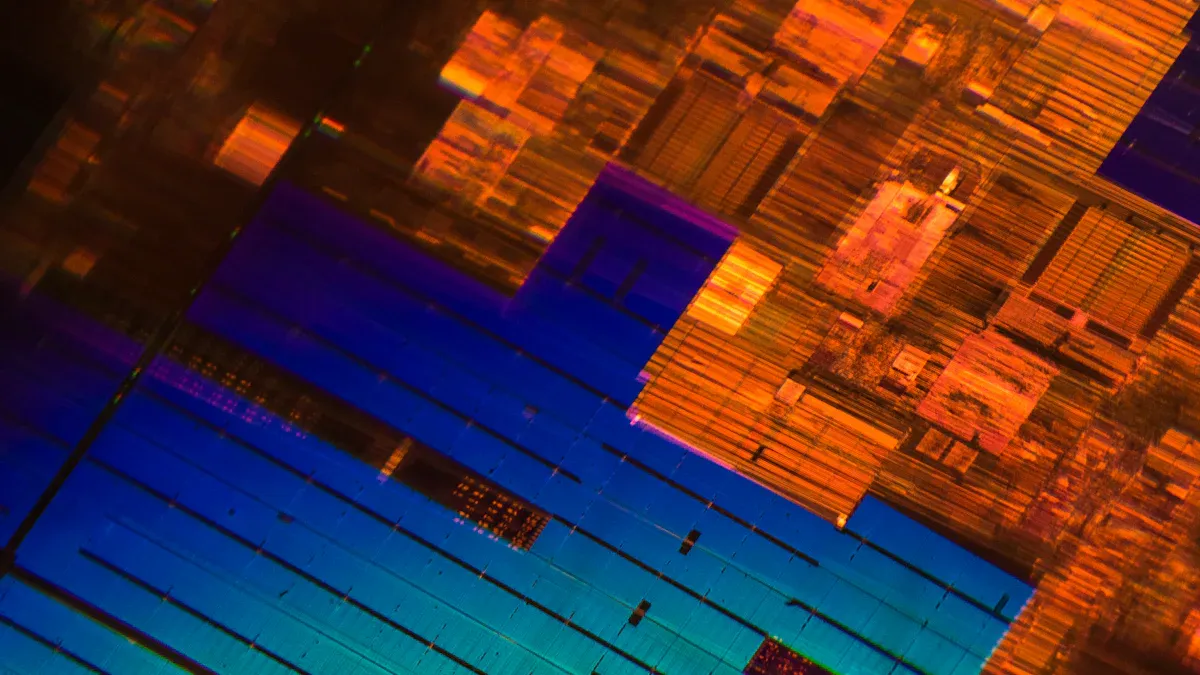

Semiconductor and Electronics Demand

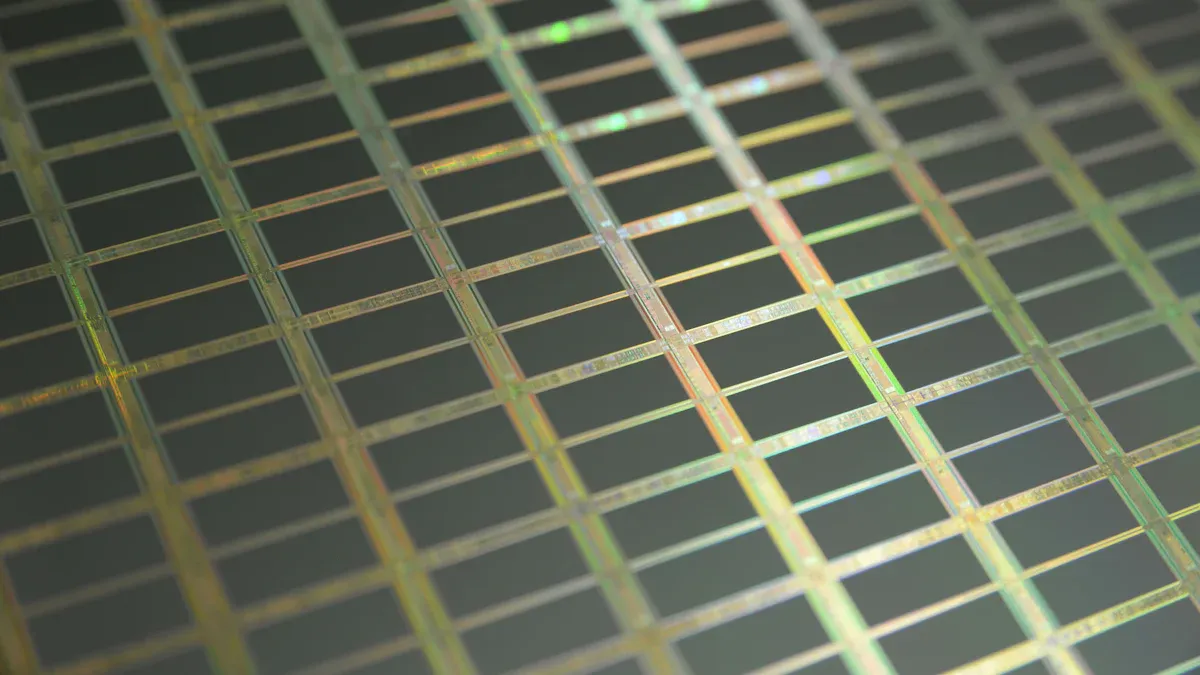

The semiconductor industry continues to grow at a rapid pace. Manufacturers seek materials that can withstand high temperatures and harsh environments. CVD SIC COATING offers excellent thermal stability and chemical resistance. These properties make it a top choice for protecting sensitive electronic components. Companies use this coating to improve the performance and lifespan of wafers, chips, and other devices.

Note: The rise of 5G networks and advanced computing increases the need for reliable coatings. CVD SIC COATING helps meet strict quality standards in semiconductor fabrication.

Aerospace and Defense Expansion

Aerospace and defense sectors demand materials that can handle extreme conditions. Aircraft engines, turbine blades, and missile components all benefit from advanced coatings. CVD SIC COATING provides a strong barrier against oxidation and corrosion. This protection extends the service life of critical parts. Defense contractors and aerospace firms invest in this technology to ensure safety and reliability.

- CVD SIC COATING reduces maintenance costs.

- It supports lightweight designs without sacrificing strength.

- The coating meets strict regulatory and safety requirements.

Energy and Power Sector Growth

The energy and power industry faces new challenges as it shifts toward cleaner technologies. Power plants, solar panels, and nuclear reactors require durable materials. CVD SIC COATING stands out for its ability to resist wear and chemical attack. Energy companies use this coating to protect equipment exposed to high temperatures and corrosive gases.

A table below highlights key benefits for the energy sector:

| Application Area | Benefit of CVD SIC COATING |

|---|---|

| Solar Panels | Improved efficiency, longer life |

| Gas Turbines | Enhanced thermal protection |

| Nuclear Reactors | Superior corrosion resistance |

These advantages help energy providers reduce downtime and increase operational efficiency.

Technological Advancements in CVD SiC Coating

Next-Generation CVD Process Innovations

Engineers continue to develop new chemical vapor deposition (CVD) methods. These next-generation processes use advanced temperature controls and improved gas flow systems. They help create coatings with better thickness and uniformity. Some companies now use digital monitoring tools to track every step. This approach reduces errors and increases production speed.

Note: Automated CVD systems lower costs and improve safety for workers.

Enhanced Material Performance

Recent research has improved the strength and durability of CVD SiC coatings. Scientists add special elements to the coating formula. These changes make the surface harder and more resistant to scratches. The new coatings also handle higher temperatures without breaking down. Many industries now trust these coatings for critical parts that face tough conditions.

A table below shows key improvements:

| Feature | Benefit |

|---|---|

| Higher Hardness | Less wear and tear |

| Better Heat Resistance | Longer part life |

| Improved Purity | Fewer defects |

Integration with Advanced Manufacturing

Manufacturers now combine CVD SiC coating with smart manufacturing tools. They use robots and sensors to apply coatings more evenly. This integration helps companies produce large numbers of coated parts quickly. It also allows for better quality control. Many factories now rely on these advanced systems to stay competitive.

CVD SiC Coating Market Segmentation

Application Trends and Shifts

Manufacturers see a shift in how industries use coatings. Electronics companies now demand thin, uniform layers for microchips. Aerospace firms focus on thick, durable coatings for engine parts. Energy providers want coatings that last longer in harsh environments. These trends push suppliers to offer more specialized solutions.

Tip: Companies that adapt quickly to these changing needs gain a strong advantage.

Regional Growth Hotspots

Asia-Pacific leads the market for CVD SIC COATING. China, Japan, and South Korea invest heavily in semiconductor and electronics manufacturing. North America also shows strong growth, especially in aerospace and defense. Europe follows with steady demand from energy and automotive sectors.

A table below highlights key regions and their main drivers:

| Region | Main Growth Driver |

|---|---|

| Asia-Pacific | Electronics manufacturing |

| North America | Aerospace and defense |

| Europe | Energy and automotive |

Emerging End-Use Sectors

New industries now explore the benefits of advanced coatings. Medical device makers use these coatings for implants and surgical tools. The automotive sector applies them to electric vehicle parts for better durability. Even the chemical processing industry seeks protection for equipment exposed to corrosive materials.

Note: As more sectors adopt CVD SIC COATING, the market continues to expand.

Competitive Landscape in CVD SiC Coating

Leading Companies and Market Share

Several companies lead the CVD SIC COATING market. These include global players such as Dow, Tokai Carbon, and SGL Carbon. Each company holds a significant share due to strong production capacity and advanced technology. Many smaller firms also compete by offering specialized solutions. The table below shows some leading companies and their estimated market share:

| Company | Estimated Market Share (%) |

|---|---|

| Dow | 22 |

| Tokai Carbon | 18 |

| SGL Carbon | 15 |

| Others | 45 |

Note: Market share numbers can change as new players enter and established firms expand.

Innovation and R&D Strategies

Top companies invest heavily in research and development. They focus on improving coating quality and reducing production costs. Many firms use advanced labs to test new materials and processes. Some companies partner with universities to access the latest research. These efforts help them create better products and stay ahead of competitors.

- Companies launch new products every year.

- They use feedback from customers to guide R&D projects.

- Many firms file patents to protect their innovations.

Expansion and Partnership Initiatives

Firms in this market often form partnerships to reach new customers. They sign agreements with equipment makers and end users. Some companies open new factories in fast-growing regions. Others join forces with local distributors to boost sales. These moves help companies grow their presence and serve more industries.

Tip: Companies that build strong partnerships can respond faster to market changes.

Future Outlook for CVD SiC Coating

Sustainability and Regulatory Impact

Sustainability shapes the future of the CVD SIC COATING market. Companies now focus on reducing emissions during production. Many governments set strict rules for chemical use and waste disposal. These regulations push manufacturers to adopt cleaner processes. Firms that meet these standards gain trust from customers and regulators.

Companies that invest in green technology often see long-term benefits.

Supply Chain and Raw Material Dynamics

Raw material supply remains a key concern for the industry. Some materials used in coatings come from limited sources. Disruptions in supply chains can slow production. Companies now look for new suppliers and local sources. They also use recycling to reduce waste and lower costs.

A table below shows common supply chain strategies:

| Strategy | Benefit |

|---|---|

| Local Sourcing | Faster delivery |

| Recycling | Lower material costs |

| Multiple Vendors | Reduced risk |

Opportunities in New Markets

New markets offer strong growth for CVD SIC COATING. Medical device makers use these coatings for implants and tools. The automotive industry applies them to electric vehicle parts. Even the food processing sector explores coatings for equipment safety.

- Companies that enter new markets can increase sales.

- Early movers often build strong brand recognition.

Key trends like advanced manufacturing, new applications, and sustainability shape the CVD SIC COATING market in 2025. Companies see strong growth and rising competition. Innovation drives better products. Proactive adaptation helps businesses stay ahead. Leaders who embrace change secure a strong position in this evolving industry.

FAQ

What industries use CVD SiC coatings most?

Electronics, aerospace, and energy companies use CVD SiC coatings most. Medical device and automotive sectors also show growing interest in this technology.

How does CVD SiC coating improve product performance?

CVD SiC coating increases durability and heat resistance. It protects parts from corrosion and wear. Many companies see longer equipment life and fewer failures.

Are CVD SiC coatings environmentally friendly?

Many manufacturers now use cleaner processes. They reduce emissions and waste. Companies that follow green standards often gain trust from customers and regulators.